zimra tax tables 2022|zimra tax tables 2021 : Manila The Zimbabwe Revenue Authority ( ZIMRA) has released the 2022 Pay as You Earn (PAYE) tax tables for those who are earning in USD and in local currency. Nude pictures of every celeb. Free galleries, fakes, naked sex scenes of vips and all leaked images. Watch your favorit playboy pics on Celebgate.

PH0 · zimra usd tax tables 2022

PH1 · zimra tax tables 2022 rtgs

PH2 · zimra tax tables 2022 pdf

PH3 · zimra tax tables 2021

PH4 · zimra paye tax tables 2023

PH5 · zimra paye tax tables 2022

PH6 · paye tax tables 2022 zimbabwe

PH7 · paye tax tables 2022

PH8 · Iba pa

Learn butane in English translation and other related translations from Filipino to English. Discover butane meaning and improve your English skills!

zimra tax tables 2022*******Find the tax tables for Zimbabwe in different currencies and periods, including 2022 and 2023. Download the PDF files for each tax table or browse the archive from 2019 to 2024.PAY AS YOU EARN ( PAYE) FOREIGN CURRENCY TAX TABLES FOR .

Zimbabwean Dollar (ZWL$) Tax Tables for 2022. Tax Free Threshold is now ZWL$ .Learn how to compute PAYE with the tax tables published by ZIMRA for foreign and local currency. Find out the tax free threshold, exempt bonus, tax period, frequency and .

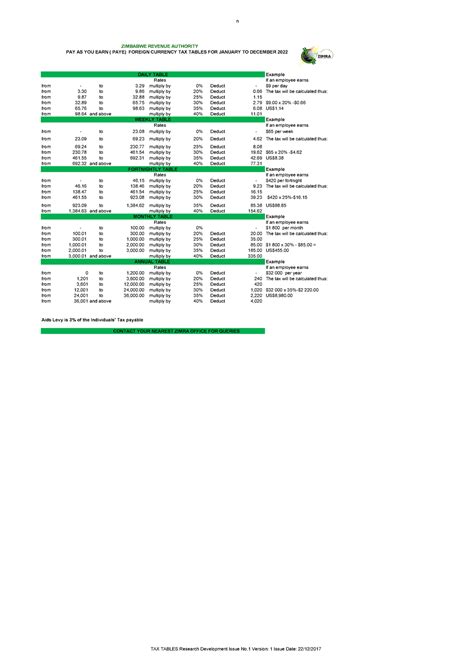

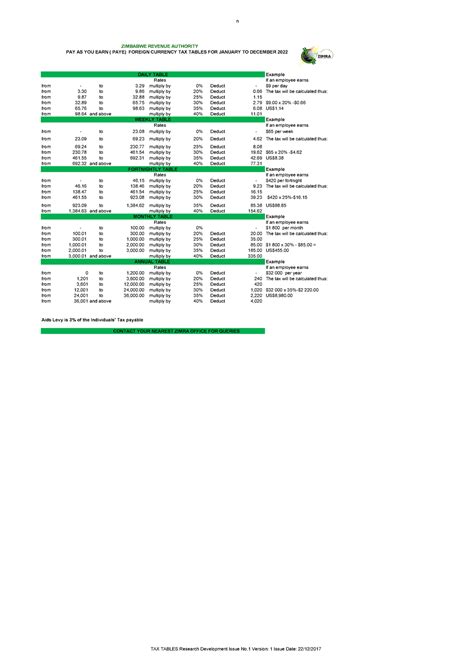

The Zimbabwe Revenue Authority ( ZIMRA) has released the 2022 Pay as You Earn (PAYE) tax tables for those who are earning in USD and in local currency. Download the PDF file of the ZIMRA PAYE tables for January to July 2022, showing the daily, weekly, fortnightly, monthly and annual tax rates and deductions. See . PAY AS YOU EARN ( PAYE) FOREIGN CURRENCY TAX TABLES FOR JANUARY TO DECEMBER 2022 Example Rates If an employee earns from - to 3.29 .

Download the PDF file of the ZIMRA PAYE tables for August to December 2022, showing the tax rates and deductions for different income levels and periods. See examples of .

With effect from 1 January 2022 the tax free threshold was increased to $300,000.00 for remuneration earned in ZWL and USD 1,200.00 for remuneration . The tax tables make it easier for taxpayers to compute PAYE with examples indicated on each and every tax table. The following are important guidelines to select .

This document outlines the PAYE tax tables for Zimbabwe from August to December 2022 for daily, weekly, fortnightly, monthly, and annual income brackets. It provides the .PAY AS YOU EARN ( PAYE) TABLES FOR JANUARY TO DECEMBER 2022 Example Rates If an employee earns from - to 821.92 multiply by 0% Deduct - $1000 per day

NB for salaries with both local and USD currency components use the USD tax tables. Deduct tax credits e.g. medical, blind persons, disabled persons and elderly person’s credits (US$900.00 for income earned in foreign currency or ZiG equivalent at the prevailing exchange rate on the day of payment, for ZiG income effective 1 January 2024).

PAY AS YOU EARN ( PAYE) FOREIGN CURRENCY TAX TABLES FOR JANUARY TO DECEMBER 2022 Example Rates If an employee earns from - to 3.29 multiply by 0% Deduct - $9 per day . CONTACT YOUR NEAREST ZIMRA OFFICE FOR QUERIES DAILY TABLE WEEKLY TABLE FORTNIGHTLY TABLE MONTHLY TABLE .

Highest tax rate. 40%. 40%. Highest Bracket of Earnings for the year. 366,120.01and above. 36,001.00 and above. The due date for the submission of PAYE returns and payment is the 10thof the following month. PAYE is calculated as follows: Determine gross income for the day/week/month/year.

TaRMS Self-Service Portal. ASYCUDA World. Domestic Taxes Contact Persons. eTip Portal. Exchange Rates. Tax Tables. Whistle-Blower Online Portal. Username *. Password *. 2022 ZIMRA PAYE USD and ZWL$ Tax Tables. You should also read. Zimbabwe’s Pay As You Earn (PAYE) Tax Tables explained; 5 New Year’s resolutions for the Zim govt;

RTGS Tax Tables 2022 - Free download as PDF File (.pdf), Text File (.txt) or read online for free. The document contains PAYE (Pay As You Earn) tax tables for Zimbabwe for 2022. It provides tax rates on a daily, weekly, fortnightly, monthly, and annual basis that are applied based on income earned within set brackets. Examples are given for calculating . PAY AS YOU EARN ( PAYE) FOREIGN CURRENCY TAX TABLES FOR JANUARY TO DECEMBER 2023 Example Rates If an employee earns from - to 3.29 multiply by 0% Deduct - $9 per day . CONTACT YOUR NEAREST ZIMRA OFFICE FOR QUERIES DAILY TABLE WEEKLY TABLE FORTNIGHTLY TABLE MONTHLY TABLE .The Tax tables below include the tax rates, thresholds and allowances included in the Zimbabwe Tax Calculator 2022. Zimbabwe Residents Income Tax Tables in 2022. Personal Income Tax Rates and Thresholds (Annual) Tax Rate. Taxable Income Threshold. 0%. Income from Z$ 0.000.00. to. Z$ 300,000.00.Foreign Currency (US$) Tax Tables for 2022. Tax Free Threshold remains at US$1200 per annum or USD100 per month. Exempt Bonus USD700 per annum. Zimbabwean Dollar (ZWL$) Tax Tables for 2022. Tax Free Threshold is now ZWL$ 300,000.0 per annum or ZWL$ 25,000 per month. Exempt Bonus is now ZWL$100,000 per annum. TAX PERIOD. from 1,201 to 3,600.00 multiply by 20% Deduct 240 The tax will be calculated thus: from 3,601 to 12,000.00 multiply by 25% Deduct 420 from 12,001 to 24,000.00 multiply by 30% Deduct 1,020 $32 000 x 35%-$2 220.00 . CONTACT YOUR NEAREST ZIMRA OFFICE FOR QUERIES DAILY TABLE WEEKLY TABLE .

TaRMS Self-Service Portal. ASYCUDA World. Domestic Taxes Contact Persons. eTip Portal. Exchange Rates. Tax Tables. Whistle-Blower Online Portal. Username *. Password *.Page 3 of 26. Fileid: . -tax-table/2022/a/xml/cycle02/source. 13:19 - 28-Nov-2022. The type and rule above prints on all proofs including departmental reproduction .from 328.78 to 986.30 multiply by 20% Deduct 65.75 The tax will be calculated thus: from 986.31 to 1,972.60 multiply by 25% Deduct 115.07 . CONTACT YOUR NEAREST ZIMRA OFFICE FOR QUERIES DAILY TABLE WEEKLY TABLE FORTNIGHTLY TABLE MONTHLY TABLE ANNUAL TABLE TAX TABLES Research Development Issue No.1 .

PAY AS YOU EARN ( PAYE) TABLES FOR JANUARY TO DECEMBER 2022 Example Rates If an employee earns from - to 821.92 multiply by 0% Deduct - $1000 per day . Aids Levy is 3% of the Individuals' Tax payable CONTACT YOUR NEAREST ZIMRA OFFICE FOR QUERIES DAILY TABLE WEEKLY TABLE FORTNIGHTLY TABLE MONTHLY .

01. Ensure you have the latest version of the zimra tax tables for the year 2022. 02. Review the instructions provided with the tax tables to familiarize yourself with the process. 03. Gather all the necessary information related to your income, including salary, bonuses, dividends, and any other additional earnings. 04.

TaRMS Self-Service Portal. ASYCUDA World. Domestic Taxes Contact Persons. eTip Portal. Exchange Rates. Tax Tables. Whistle-Blower Online Portal. Username *. Password *. A 3% (of tax liability) AIDS levy must be added to the total tax liability calculated. Inclusive of the AIDS levy, the top effective rate for employment income changed from 46.35% to 41.20% and the top effective rate for other income is 24.72%. Individual - Significant developments;

Other tax tables. Schedule 4 – Tax table for return to work payments (NAT 3347) Schedule 10 – Tax table for payments made under voluntary agreements (NAT 3352) Schedule 14 – Tax table for additional amounts to withhold as a result of an agreement to increase withholding (NAT 5441) For withholding rates for: individuals employed in that .zimra tax tables 2021 Other tax tables. Schedule 4 – Tax table for return to work payments (NAT 3347) Schedule 10 – Tax table for payments made under voluntary agreements (NAT 3352) Schedule 14 – Tax table for additional amounts to withhold as a result of an agreement to increase withholding (NAT 5441) For withholding rates for: individuals employed in that .

European Roulette. In European Roulette, the wheel has 36 numbers and a zero. To distinguish the game from the French variant, the European roulette table shows English descriptions and announcements are made in English. . When you play roulette online for free, you are wagering play money and playing just for fun. Therefore, you cannot .

zimra tax tables 2022|zimra tax tables 2021